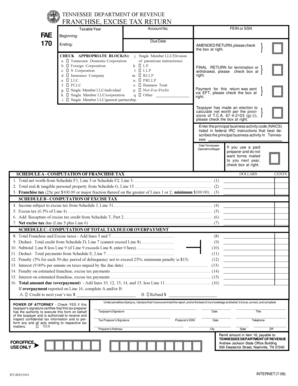

tn franchise and excise tax return

All entities doing business in Tennessee and having a substantial nexus in Tennessee except for not-for-profits and other exempt entities are subject to the franchise tax. FT-1 - Franchise Tax Computation.

Fae170 Fill Online Printable Fillable Blank Pdffiller

Follow these steps to generate Form FAE-170 in the Individual module.

. 67-4-2007 The franchise tax is also levied upon the. Click on Make an ACH Debit Payment or Make a Credit Card Payment hyperlink and provide the information as requested. About TNTAP-12 Closing a Tax Account in TNTAP.

Franchise tax 25 cents per 100 or major fraction thereof of the greater of either net worth or real and tangible property in Tennessee. Select the applicable Form CtrlT from dropdown menu. Our specific services include state income and franchise tax indirect tax business restructuring credits and incentives sales and use tax outsourcing excise tax property tax state strategic tax review and state tax controversy.

The excise tax is based on net earnings or income for the tax year. Log in to TNTAP. Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for Tennessee purposes.

The franchise tax is based on the greater of the entitys net worth or the book value of certain fixed assets plus an imputed value of rented property. If your tax preparer has filed your return and you only need to make a payment follow these steps. Schedule E rental Schedule FForm 4835.

The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business. When you have completed all of pages on the return. A Amended return b Final return NAICS SOS Control Number c Public Law 86-272 applied to excise tax d Taxpayer has made an election to calculate net worth per the provisions of Tenn.

Ad Download Or Email FAE 170 More Fillable Forms Register and Subscribe Now. Please view the topics below for more information. Once completed click the Submit button to pay your tax.

Select Tennessee SMLLC Franchise Excise Tax Return from the left navigation menu. Franchise tax may be prorated on short period returns but not below the 100 minimum. The excise tax is based on net earnings or income for the tax year.

The franchise tax may not be prorated. General partnerships and sole proprietorships are not subject to the tax. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business in Tennessee regardless of whether the company is active or inactive.

Franchise and Excise Taxes The Franchise and Excise Taxes The excise tax is a tax imposed on the privilege of doing business in Tennessee. 025 per 100 based on either the fixed asset or equity of the entity whichever is greater. TNTAP is Tennessees free one-stop site for filing your taxes managing your account and viewing correspondence.

The tax is based on net earnings or income for the tax year. Form TN FAE 170 F Franchise Excise Tax Return for Tennessee is only included in the State Business Forms program when using the TurboTax Business Edition. Select Yes to Is this a final return for termination or withdrawal.

When calculating Franchise Tax if the holding entity owns an interest in several other entities its equity can potentially be taxed more than once. The minimum franchise tax payable each year is 100. The Business Edition can only be installed on a Windows based personal computer not on a Mac or online.

File your final return for termination or withdrawal. The Tennessee Franchise and Excise tax has two levels. Select the File Now link for the current Franchise and Excise return.

The franchise and excise tax return and minimum tax is required even if your charter or qualification has been forfeited. 65 excise tax on the net earnings of the entity and. The minimum tax is 100.

E-file-13 - How to Pay Franchise and Excise Tax Online. The franchise tax rate is 25 cents per 100 or major fraction thereof applied to the greater of a taxpayers net worth or the book value o f property owned or used in Tennessee at the close of the tax year covered by the required return. What is FAE tax.

Go to Screen 54 Taxes. Complete the Short Period Return Worksheets and retain them for your records when filing a short period return. RV-R0011001 921 TENNESSEE DEPARTMENT OF REVENUE 2021 Franchise and Excise Tax Return FAE 170 Tax Year Beginning Account Number Tax Year Ending FEIN Check all that apply.

The franchise tax is based on the greater of net worth or the book value of real or tangible personal property owned or used in Tennessee. The minimum franchise tax of 100 is payable if you are incorporated domesticated qualified or otherwise registered through the Secretary of State to do business in Tennessee regardless of whether the company is active or inactive. 1 - 3 years experience in state income and franchise tax.

The franchise tax is a privilege tax imposed on entities for the privilege of doing business in Tennessee. The Business Edition cannot complete a personal tax return Form 1040. The excise tax is 65 of the net taxable income.

Ad Download Or Email FAE 170 More Fillable Forms Register and Subscribe Now. To close a Franchise and Excise Tax Account. Excise tax 65 of Tennessee taxable income.

Form Fae 170 Franchise And Excise Tax Return Kit

Form Fae170 Rv R0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae172 Download Printable Pdf Or Fill Online Quarterly Franchise Excise Tax Declaration Tennessee Templateroller

Free Form Fae 170 Franchise And Excise Tax Return Kit Free Legal Forms Laws Com

Franchise Excise Tax Workshop Youtube

Franchise Excise Tax Workshop Calculation Of Taxes Youtube